portability estate tax definition

2001 b 1 on the estate of the deceased spouse. However that exemption is scheduled to return to 5000000 as adjusted for inflation in 2026.

Understanding Qualified Domestic Trusts And Portability

Its important to get help from your estate attorney andor.

. 2010 c 5 A if that estate was not required by Sec. The term portability refers to a legal term used to refer to the ability to transfer an estate tax exemption to a surviving spouse. The estate tax portability rules save your estate from almost being cut in half when sent to your heirs.

Attach a statement to the return that refers to the particular treaty applicable to the estate and write that the estate is claiming its benefits. As of January 1 2018 the estate tax exemption for individuals is 112 million adjusted for inflation. If the portability election is filed in time the entire estate of 60 million will be named under the wife.

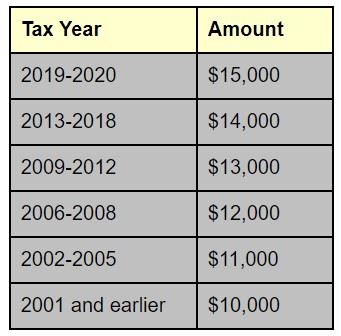

A surviving spouses taxable estate may be greater than his or. Currently the federal estate tax exemption is 11400000 per spouse. On January 1 2013 Congress passed the American Tax Relief Act of 2012 ATRA which President Obama signed on January 2 2013.

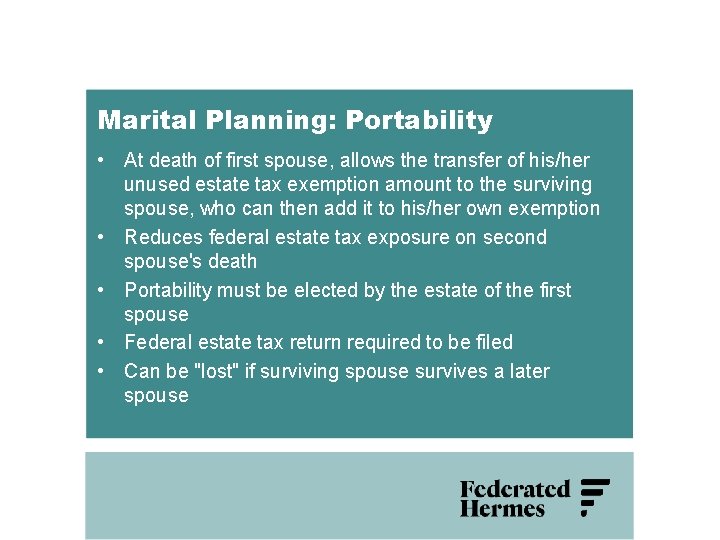

In other words if your assets are worth 112 million or less at the time of your death and you have not used any of your combined estate and gift tax exemption your estate owes no estate tax. So this is a discussion you can have with the family to make sure they understand the cost and the potential benefits of portability and they can. Again to elect portability the deceased spouses estate has to file an estate tax return and if that isnt otherwise required that introduces some complexity and some cost into that process.

Definition of Portability of the Estate Tax Exemption So what does portability of the estate tax exemption mean. Prior to the enactment of the portability law in 2010 most estate plans for married couples set aside at the first. A surviving spouses tax return will be largely dependent on the portability of the exemption.

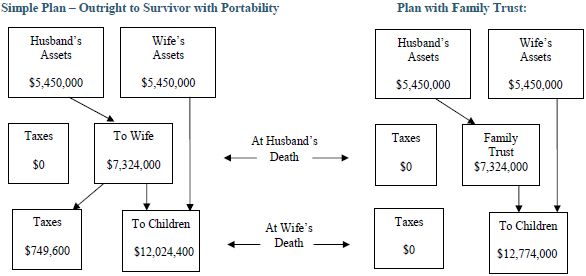

The effect of portability is that a married couple has a combined 234 million exemption from the federal estate and gift tax and a combined 10 million exemption from the Maryland estate tax for 2021. Estate tax portability means that the unused portion of the first-to-die spouses estate tax exemption passes to the surviving spouse. In simple terms portability of the federal estate tax exemption between married couples comes into play if the first spouse dies and the value of the estate does not require the use of all of the deceased spouses federal.

What is estate tax portability. 2010 c 4 refers to the amount with respect to which the tentative tax is determined under Code Sec. Portabilitys Effect on Tax-Efficient Estate Tax Planning.

The wife has to file the IRS Form 706 federal estate tax returns to get the portability within 270 days after her husbands death. The key is to file for estate tax portability on time. 6018 a to file an estate tax return.

The current estate tax exemption is 525 million 5 million with adjustments for inflation. Portability is the ability to move a certain amount of money that can be left to others tax-free for estate planning purposes as described by WMUR9s article Money Matters. 2017-34 the IRS provided a simplified method for obtaining an extension of time under Regs.

Assets are exempt from US. Before the new tax laws spouses were not allowed to share their exclusions. It can be used in any of the four ways listed above.

When computing the DSUE amount Code Sec. This means that a married couples total estate tax exemption is currently 105 million. The non-exempted amount of 545 million would be portable and would be passed to his wife.

Estate tax pursuant to the applicable treaty. Normally you have 9 months from the date the first spouse dies but you can file for that 6-month extension if necessary. 2017-34 this simplified method which is used in lieu of the letter.

In order to elect portability a surviving spouse must file an estate tax return Form 706 for the federal estate tax and Form MET-1 for the. Entries for the gross estate in the US the taxable estate and the tax amounts should be 0 if all of the decedents US. One of the key provisions of ATRA is to make permanent the so.

3019100-3 to make a portability election under Sec.

Portability How It Works For Estate Tax Batson Nolan

Exploring The Estate Tax Part 2 Journal Of Accountancy

Credit Shelter Trusts And Portability Eagle Claw Capital Management

Estate Tax Exemption Portability Law Video

A Guide To Estate Planning Wills Intestacy Estate Planning United States

Advanced Estate Planning Topics Who Needs Advanced Estate

Postmortem Tax Planning Ppt Download

An Overview Of Estate Tax Portability Provisions Aicpa Insights

Estate Planning Basics Advanced Directives

Estate Planning Discussion What Is Portability And How Can It Affect You

Tackling Tax Issues If You Re An Estate Executor Ferrari Ottoboni Caputo Wunderling Llp

It S So Important To Elect Portability For Your Farm Estate Agweb

How Portability Dsue For Estate And Gift Taxes Could Save You Millions No Really Atticus Magazine

Credit Shelter Trusts And Portability Eagle Claw Capital Management

Estate Planning Part One Of A Lifelong Journey Rdg Partners

Irs Announces 2017 Estate And Gift Tax Limits The 11 Million Tax Break