tax incentives for electric cars australia

3000 rebate for first 25000 EVs priced under 68750 sold from September 1. A 3000 subsidy is available for 7000 new battery electric and hydrogen fuel cell vehicles valued below 68750 including GST registered in South Australia from 28 October 2021.

How To Extinguish Electric Vehicles Fire Step By Step Video Guide E Mobility Simplified Basics Of Electric Vehicles Electric Cars Vehicles High Voltage

The NSW Electric Vehicle Strategy outlines a number of incentives to encourage the purchase of battery electric vehicles BEVs and hydrogen fuel cell electric vehicles FCEVs in NSW.

. 2 per 100 up to 100000 dutiable value and 4 per 100 value thereafter compared to up to 6 per 100 for more polluting vehicles. Almost 75 per cent of members. On top of paying less stamp duty Queensland EV buyers get access to a 3000 per person incentive scheme when purchasing an EV up to 58000.

Non-financial incentives such as access to bus lanes. Savings on vehicle price. To support the uptake of electric vehicles in South Australia the government is providing a 3000 subsidy and a 3-year registration exemption on eligible new battery electric and hydrogen fuel cell vehicles first registered from 28 October 2021.

Plug-in Hybrids and Fuel Cell Vehicles that are priced under the increased Luxury Car Tax threshold for low emission vehicles of 79659. To achieve this the SA government is offering financial incentives for EV buyers including a 3000 rebate for new EVs and FCEVs that cost up to 68750 limited to the first 7000 cars. At the same time Scott Morrison is saying that Australia is leading the world in the transition away from fossil fuels all of the top 10 company cars in.

The plan would see a Labor. Tax office ruling says EV drivers can claim business deductions at same rate as petrol cars. Given lower rates of fuel and maintenance that represents potential saving of 2200 a year for EV owners.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. 3000 rebate for 4000 vehicles in first round. From 28 October 2021 the SA Government will offer a 3000 rebate on the first 7000 new battery electric vehicles with a Vehicle Subtotal dutiable value of less than.

The first 7000 electric vehicles bought from 28 October 2021 qualify for a 3000. Electric and hybrid vehicles pay reduced stamp duty. Key to this is transferring the entire government vehicle fleet to electric cars by 2025.

Policy settings to encourage Australian manufacturing of electric car components. 8 rows The only electric car incentives in Australia at a federal level is a higher luxury car tax. In terms of stamp duty drivers pay 2 per 100 in.

The state is also offering a subsidy of up to 2000 to install EV smart chargers at home limited to 7500 households. One of the incentives offered by the NSW Government is a cash rebate of 3000 on 25000 eligible vehicles. More than 20000 subsidies in total.

Australian Capital Territory. South Australians can access 2 electric vehicle incentives. The policy would cost 200 million over three years and would work by exempting some electric vehicles EVs below the luxury-car tax threshold of 79659 from import tariffs and fringe benefits tax.

Tasmania A two-year waiver on stamp duty has been introduced for new and second-hand EVs which is expected to save EV drivers around 2000 in costs. According to Australias Electric Vehicle Council key incentives toward broader EV ownership can include financial subsidies to help bridge the gap between the cost of an EV and internal combustion engine ICE vehicle. As at 8 April 2022 there are 6874 electric vehicle subsidies remaining.

The first 25000 EVs. 3000 subsidy for 7000 new electric vehicles. We know that upfront purchase price is one of the barriers hindering purchase of.

Incentives for electric vehicles. While luxury brands such as BMW have repeatedly called for tax incentives in Australia to help sell its premium-priced electric cars mainstream manufacturer Kia. The South Australian governing administration has available no electric powered auto incentives to speak of but it has determined to implement the fantastic ol 25c per km highway tax on EVs commencing from July 2022.

The South Australian government has offered no electric car incentives to speak of but it has decided to implement the good ol 25c per km road tax on EVs starting from July 2022. New EVs are exempt from stamp duty about 1350 for a 45000 car New South Wales. These include tax rebates infrastructure subsidies stamp duty exemptions and registration discounts.

Electric Cars Rise To Record 54 Market Share In Norway Electric Hybrid And Low Emission Cars The Guardian

Growing Demand For Electric Vehicles A Boost For Indonesia S Economy Opinion The Jakarta Post

How To Get Australians To Buy Electric Cars Canberra Provides A Guide

Electric Cars Australia Tesla Nissan Hyundai Renault Kia Jaguar

When Will Electric Cars Be Affordable In Australia Will Ev S Ever Be Cheap Carsguide

Queensland Introduces Ev Purchase Incentives Electrive Com

Top Economists Call For Measures To Speed The Switch To Electric Cars

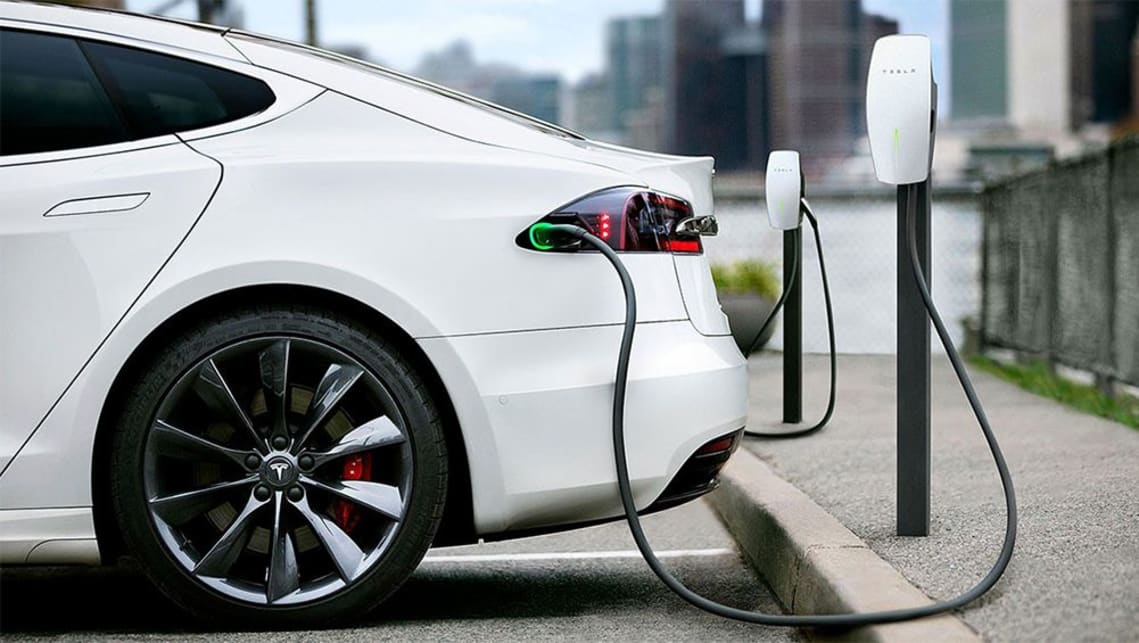

What Is The Electric Vehicle Charging Standard In Australia

Thinking Of Buying An Electric Car Here S What You Need To Know About Models Costs And Rebates Electric Vehicles The Guardian

Group Calls For Electric Vehicles To Be Exempt From Stamp Duty If Sa Road User Charge Passes Abc News

Victorian Tesla Electric Car Uptake More Than Doubles In First Quarter 2022

Electric Cars Pros And Cons Advantages Disadvantages Of Evs Carsguide

Electric Vehicles The Revolution Is Finally Here Financial Times

How Many Electric Cars In Australia Ev Sales Statistics Percentages Trends Carsguide

China Sweden And Germany Lead The Way On The Ey Electric Vehicle Country Readiness Index Ey Denmark